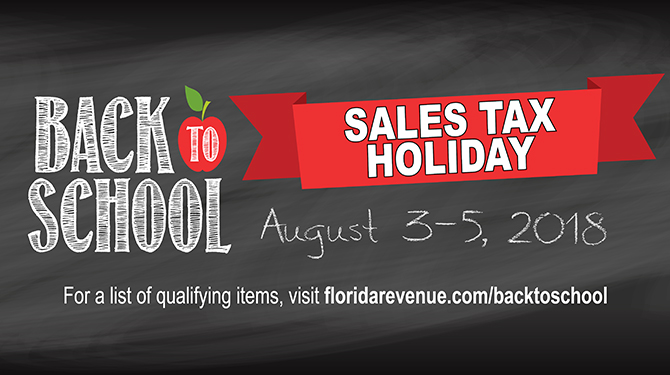

For all of our veterans and their spouses enrolled in classes, or those with children in school: don’t forget this year’s Back-to-School Sales Tax Holiday begins this Friday, August 3, 2018, at 12:01 AM, and ends Sunday, August 5, 2018. The 6% state sales tax will be waived throughout Florida to help residents save on clothing and school supplies.

During this time, no sales tax will be collected on purchases of:

- Clothing, footwear and certain accessories selling for $60 or less per item

- Certain school supplies selling for $15 or less per item

The sales tax holiday does NOT apply to:

- Any item of clothing selling for more than $60

- Any school supply item selling for more than $15

- Books that are not otherwise exempt

- Rentals or leases of any eligible items

- Repairs or alterations of any eligible items

- Sales of any eligible items in a theme park, entertainment complex, public lodging establishment, or airport.

View the complete list of tax-exemptible items on the Department of Revenue’s Tax Information Publication (TIP) on the 2018 Back-to-School Sales Tax Holiday. For more details, visit the Frequently Asked Questions.